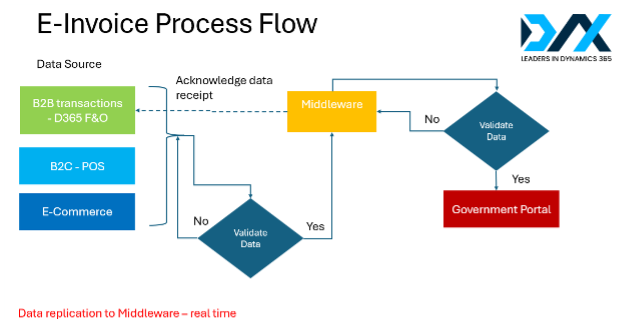

Overview

IRB has mandated the electronic transmission of sales data

- Memorandum consisting of rules governing issue of E-Invoice released in Sept 2023.

- Customer had changed 2 partners without successful resolution.

- Imposition of penalties for non-compliance.